Experience the power of Luzmo. Talk to our product experts for a guided demo or get your hands dirty with a free 10-day trial.

May 31, 2023

Mieke Houbrechts

Is slow innovation holding you back? Here are 4 ways to sell properties faster, avoid costly risks and make more revenue thanks to real estate data analytics.

Digital technology is leaving its mark on every industry. Real estate and construction is no exception. Even though the sector is slow to digitalize, real estate data analytics are altering how these businesses operate.

How are real estate businesses leveraging data to make smarter decisions? And how can data continue to revolutionize the industry? Explore the impact of data analytics in real estate, and common use cases.

Real estate analytics is the collection, processing, and analysis of data related to real estate markets. It helps anyone active in real estate make more informed, impactful decisions. Whether it's realtors, property managers, project developers, investors, and so on.

Real estate analytics uncover crucial insights in different areas, such as:

Its main goal is to translate raw real estate data into actionable information. That way, you never have to leave an opportunity on the table. Likewise, you won't have to bear the consequences of making a poor business decision.

Even though most home buyers start searching for their new homes online, the real estate sector is far from digitalized. Contracts, ground plans, home showings,... Most of the time, these processes still happen in person or on paper.

With more and more PropTech tools available, things are starting to change. Property and construction managers start to have the right data at hand, at the right time. And that makes it much easier to predict market trends and make informed decisions.

Data analytics in real estate means the difference between a profitable deal and a missed opportunity. Investments are less risky when you back your decisions with data. And in a volatile, competitive market, this data intelligence will help innovative players thrive.

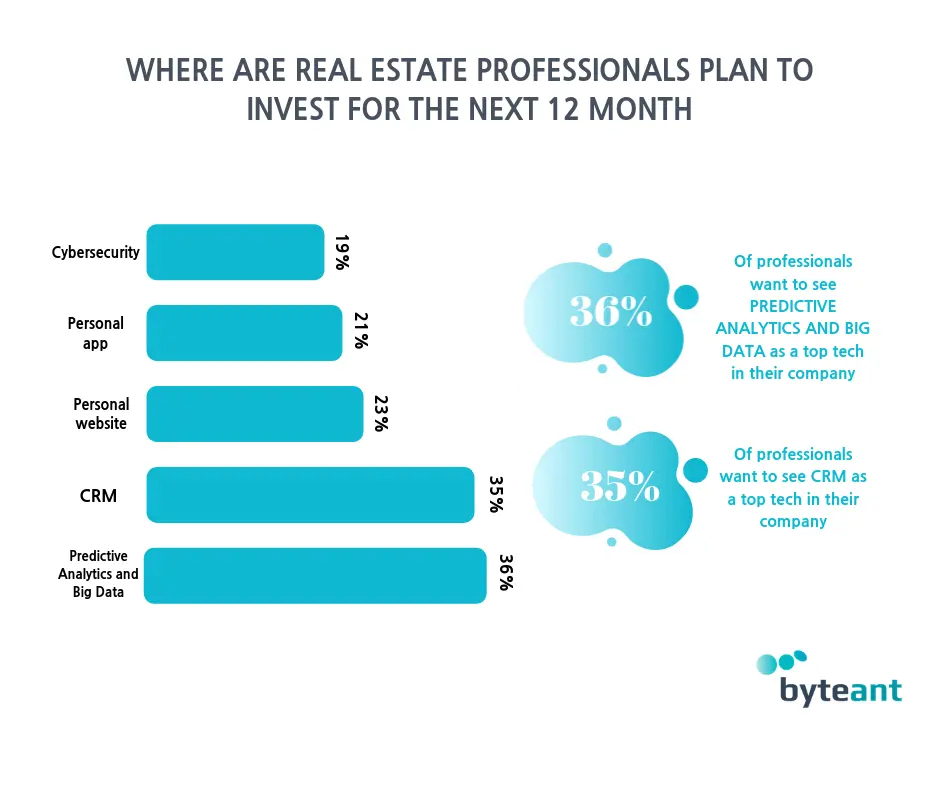

Real estate professionals are starting to realize the endless potential of data. As much as 36% plans to invest in predictive analytics and big data. As a result, more businesses are searching for tools to help them make sense of data. One such tool that has gained popularity in recent years is a deal sourcing platform, which helps real estate professionals identify and analyze potential investment opportunities.

Making the move from pen and paper to digital tools doesn't happen overnight. Businesses that have been analog until now will lack important data in many areas.

Luckily, modern real estate analytics software can bridge part of that gap. The sooner you start investing in PropTech, the faster you can kickstart innovation. Modern PropTech tools collect, manage and analyze different types of real estate data. Whichever digital information you were missing before, you can now collect, input, and analyze.

Even for businesses leading the pack in digitalization, new technology brings new opportunities. Real estate analytics software uncovers patterns and trends that are impossible to spot manually. It can help with automatic property valuation, predictive analytics or customer behavior analysis.

These advanced insights were a distant dream for businesses without a data scientist on their team. But with today’s PropTech analytics tools, anyone can make meaningful, data-driven decisions.

As a real estate professional, you can harness the power of real estate data analytics for many use cases. Let’s explore a few of the most common ones below.

Deciding how much a property is worth can be a difficult process. Data analytics can help you become aware of all factors affecting property valuation. Whether it's location, size, condition, comparable properties, or market trends.

With a comprehensive view of all these factors, you'll make more effective valuations. And as a result, make better real estate investments, or sell or rent your property faster.

Jurny, an AI hospitality platform, is a great example in the short-term rental sector. They offer dynamic pricing tools to help owners increase the revenue of their rental properties.

By analyzing data on historical pricing, supply and demand, and economic factors, real estate professionals can identify market trends and make predictions about future movements. Alte, a real estate investment platform, uses data to help its customers make better real estate investments and stay on top of their portfolios.

Real estate investments aren’t without risk. Small mistakes can become costly expenses. Data analytics can help you identify potential risks and make informed decisions. Whether it’s during the construction process or later during maintenance.

More and more often, property managers use IoT or smart meters to uncover problems that could cost them millions. Software platform Smartvatten, for example, helps property managers monitor water consumption and avoid costly leaks or overconsumption.

Another example is property inspection. PropTech companies like Brightchecker are making striding efforts to digitalize the industry. With online surveys instead of paper, it’s now possible to analyze inspection data and identify problems on a larger scale.

Finding the right buyer for your real estate property - or vice versa - can be a challenge in the world of real estate sales. Yet, data analysis can significantly speed up the real estate sales process. The more data points you have, the easier it will become to match buyers and sellers in the real estate market.

Consorto, a B2B marketplace for commercial real estate, uses data to match brokers, sellers and investors quicker. With information like location, price and risk profile, they lead their product users to the opportunities they’re looking for.

Real estate data analytics is reshaping the industry. More efficiency, less risk and better investment opportunities are only a few of the many benefits. And yet, software vendors are not grabbing the full opportunity just yet.

Only 20% of PropTech companies already offer interactive insights inside their software application. Most businesses still rely on quarterly business reviews, Excel or ad-hoc PDFs. Not surprisingly, 4 out of 5 PropTech vendors get negative reviews on G2 about their analytics experience.

However, the future looks brighter. 29% say data analytics is a top priority for 2023. And off-the-shelf analytics tools like Luzmo make it easier for PropTech companies to add interactive dashboards to their product offering in days, instead of months.

Data is the future of real estate. Download our innovation guide, and learn how to unlock insights from your real estate data.

Experience the power of Luzmo. Talk to our product experts for a guided demo or get your hands dirty with a free 10-day trial.